Housing

There are many federal, state, and community housing resources available to help low and moderate-income renters, homebuyers, and homeowners.

There are many resources available to help increase and preserve homeownership for low and moderate-income individuals and families. These resources provide information on topics such as the lending and home buying process, mortgage programs and products for first-time home buyers, down payment/purchase assistance for eligible first-time borrowers, credit barriers, predatory lending prevention, and foreclosure prevention.

- Washington Homeownership Resource Center provides referrals to pre-purchase homebuyer education classes, foreclosure prevention counseling, alternative homeownership options (such as community land trusts and self-help housing) and information about down payment assistance programs. To speak to someone, call 877-894-4663.

The Consumer Financial Protection Bureau (CFPB) has information and resources to help homebuyers and homeowners feel more confident, become more informed, and make smarter decisions about mortgages. Buying a House is an online suite of tools and resources to help consumers navigate the home-buying process.

Washington Department of Financial Institutions also provides tips and resources for first time homebuyers and current homeowners.

You can also attend a local homebuyer education seminar. These classes are FREE and are at least five hours long. There are different types of homebuyer education classes advertised by a variety of sources. Many banks, brokers, and real estate offices offer classes; however, some may be biased towards their own products and services. Seminars offered by nonprofits and sponsored by Washington State Housing Finance Commission (WSHFC) or the NeighborWorks Center for Homeownership Education and Counseling are designed to provide neutral, unbiased education on the home-buying process. Find a list of virtual and in-person homebuyer education classes through the WA State Housing Finance Commission.

Understanding Foreclosure

Are you, or someone you know, having trouble paying your mortgage? This can be a scary, confusing and frustrating situation. Learn about the foreclosure process and the FREE resources available to help struggling homeowners keep their homes.

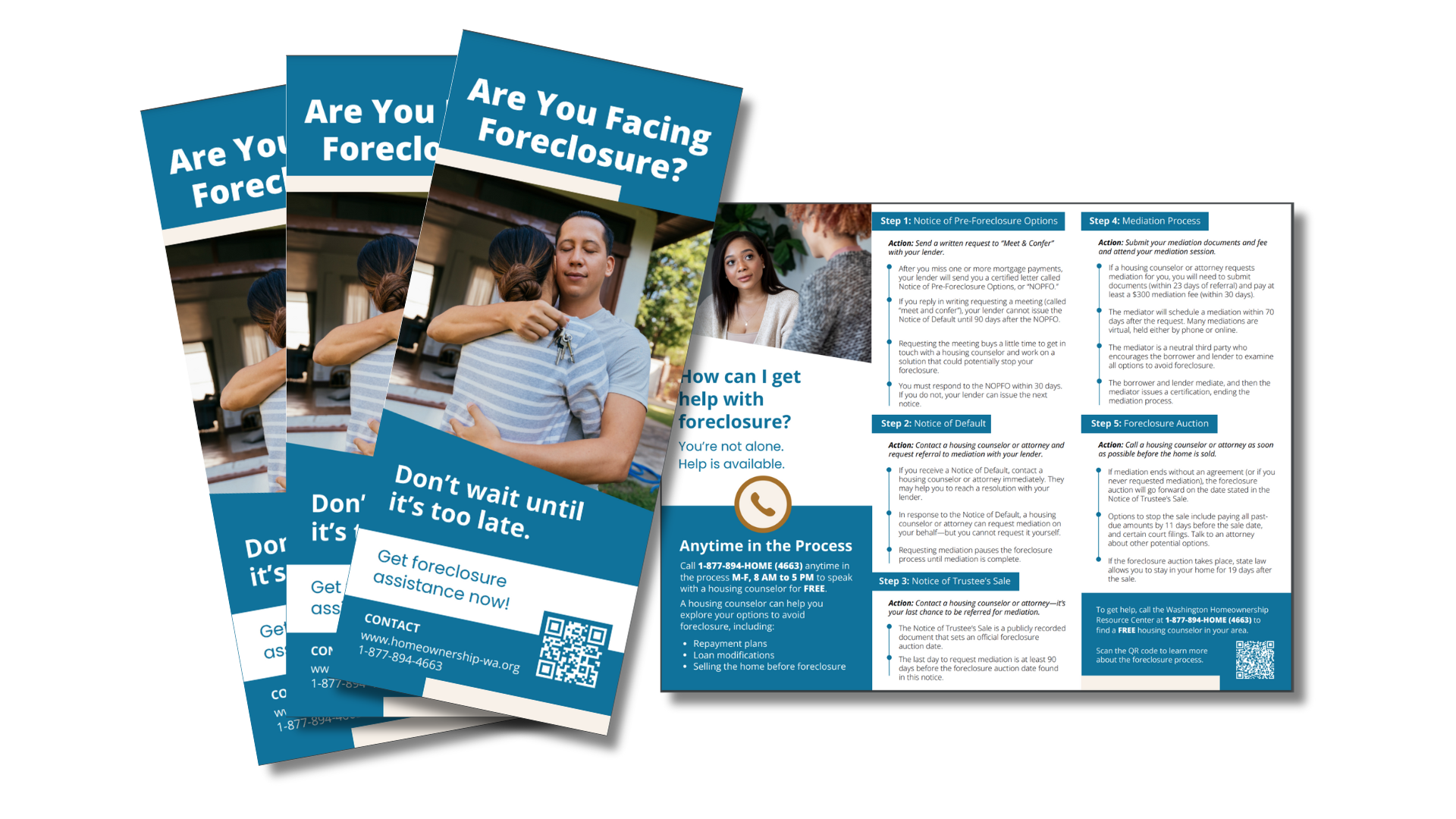

Foreclosure Prevention Flyer

The WA Department of Financial Institutions, Department of Commerce, Northwest Justice Project, WA Homeownership Resource Center and Financial Empowerment Network worked together to create a pamphlet with reliable and important information on foreclosure. It may help you understand where you are in the foreclosure process and what options and resources are available.

Download the Foreclosure Prevention Pamphlet for free:

Foreclosure Prevention Flyer - English

Foreclosure Prevention Flyer - Arabic

Foreclosure Prevention Flyer - Chinese

Foreclosure Prevention Flyer - Korean

Foreclosure Prevention Flyer - Russian

Foreclosure Prevention Flyer - Spanish

Foreclosure Prevention Flyer - Tagalog

Foreclosure Prevention Flyer - Ukrainian

Foreclosure Prevention Flyer - Vietnamese

These flyers were reviewed and updated in 2024

We are seeking a community volunteer to help us review the translation in Amharic. The flyer has already been translated by a professional translator. Please reach out if you would be willing to review and provide feedback on the translation. Thank you!

For more information about how you can prevent foreclosure, call the Washington State homeownership information hotline at 1-877-894-HOME (4663).

Videos on Foreclosure Prevention

The WA Department of Financial Institutions, Department of Commerce, Northwest Justice Project, WA Homeownership Resource Center and Financial Empowerment Network have produced updated videos that clarifies the foreclosure process and shows why it is important for you to seek help as soon as possible. Don’t wait until it’s too late!

Watch this video: Plain Talk About Foreclosure

Vídeo en español: Una Plática Franca Sobre la Ejecución Hipotecaria

These videos were reviewed and updated in 2025

Washington Foreclosure Prevention Resource Guide

This Foreclosure Prevention Guide is a resource for homeowners at risk of foreclosure, including a Mediation Toolkit. (This guide provides general information concerning your rights and responsibilities. It is not intended as a substitute for specific legal advice. Make sure you reach out for help about your specific circumstances today.)

Note: If you are a homeowner seeking help with your mortgage, please contact a housing counselor or legal aid attorney by calling the Washington Homeownership Hotline at 877-894-4663 (toll-free) or (206) 542-1243 in Seattle.

For legal assistance, call the Northwest Justice Project’s Foreclosure Prevention Hotline at 800-606-4819.

Washington State Department of Financial Institutions

Beware of Foreclosure Rescue Scams: The Washington State Department of Financial Institutions advises homeowners who are delinquent on their mortgage to be cautious about using the services of someone offering to help them work with their lender to modify the terms of their home loan. Solutions that sound too simple or too good to be true usually are. Many bad actors are waiting to take advantage of homeowners in trouble. Don’t pay anyone who offers to help you for a fee.

Washington Homeowner Assistance Fund (HAF) - Now Accepting Applications

The Washington State Homeowner Assistance Fund (HAF) is a federally funded grant program that is in place to mitigate the effects of the Covid 19 pandemic on homeowners in Washington State. The Washington State Housing Finance Commission (WSHFC) is managing this program. What you can do now: Homeowners who are behind on their mortgage payments should call the Washington Homeownership Resource Center Hotline at 877-894-4663 to get connected with a housing counselor who can provide guidance with your specific situation. Depending on your situation, the counselor will apply for the HAF program on your behalf.

Be wary of scams: There is absolutely no fee to receive assistance in applying for this program! Call the state hotline to get help that is free and safe.

Learn more about the HAF by calling the Washington Homeownership Resource Center.

At Washington Law Help you will find general information, self-help packets, and resources to assist you with foreclosure.

Black Home Initiative (BHI) is a new regional effort that seeks to target the racial inequities at the core of the housing ecosystem in an effort to increase homeownership among Black households in the South Seattle, South King and North Pierce County communities.

Discriminatory housing practices such as redlining and racially restrictive covenants have a long history in the Seattle-Tacoma region. Their harmful impacts have been exacerbated by the current shortage of affordable housing and our area's red-hot growth. Today’s homeownership gap directly reflects the persistence of this systemic discrimination.

Black Home Initiative is a network of nonprofits, private companies, philanthropy, governments and associations making up our region’s ecosystem focused on increasing Black homeownership. Join the BHI network!

Home repairs can be both costly and urgent. And, if you have changing mobility and ability needs related to aging, injury, or emerging disability, you may find your home no longer accommodates your needs. Help may be available, especially if you or someone in your home is a veteran, senior, or person with a disability, and your household income is limited. WA Homeownership Resource Center can help determine if there is a program in your area that would be a match for your needs.

At Washington Law Help you will find general information, self-help packets, and resources to assist you with tenant’s rights.

Solid Ground: Operates a statewide hotline for tenants seeking information on the Residential Landlord/Tenant Act and renters’ rights. Tenant counselors can provide legal referrals and action plans appropriate to each tenant’s needs. The hotline number is 206-694-6767.

HUD: Tenant Rights, Laws, and Protections in Washington State.

For low-income permanent housing resources search HUD subsidized properties.

Tenants Union: For landlord-tenant information and aid in settling disputes, call the Tenants Union at 206-723-0500 or visit their website.

For rental assistance resources, contact the Community Information Line at: 2-1-1 (from a landline only) or toll free 1-877-211-9274.

Emergency Cash Assistance: If you have an emergency and need a one-time cash payment to get or keep safe housing or utilities, you may be eligible for the Additional Requirements for Emergent Needs (AREN).