2025 Bank On Washington Forum Program

Download the complete printed program

Attendee Directory

Get connected with your fellow attendees!

Take in Tacoma

Downtown Tacoma has so much to offer! Please check out this list of local businesses, compiled by the University of Washington Tacoma:

Local Restaurants, Cafes, Bars & More | Office of Events & Conferences | University of Washington Tacoma

Get Involved

Are you interested in getting involved with Bank On Washington or the Financial Empowerment Network? Let us know!

FEN Newsletter

Sign up to receive FEN newsletters! Our newsletters serve as a community bulletin board for our network of partners. We share local resources, highlight events organized by our partners, and you’ll be the first to know about FEN’s upcoming events, like workshops and gatherings.

Invest in Our Community

Make a donation to FEN and support our growing financial empowerment community!

Agenda & Schedule

| Time | Session | Location |

|---|---|---|

| 9:00AM | Registration & Check-In | Cherry Park Lobby |

| 10:00AM | A: Welcome & Intention Setting | Milgard Assembly |

| Ryan Davis, Financial Empowerment Network Jerrel Jones, Credit Revolution Education Directors Mandy Lee, Verity Credit Union | ||

| 10:15AM | B: Interrupting the Spirit of Scarcity - Embracing Abundance | Milgard Assembly |

| Valériana Chikoti Bandua Estes, Necessary Interruptions Alex Panagotacos, Alex Panagotacos Consulting | ||

| 11:15AM | Break | Columbia Bank Lobby |

| 11:30AM | C: Money Trauma & Healing Centered Systems | Milgard Assembly |

| Jenefeness Franke, Fiscal Finesse Sabrina Smith, Columbia Bank Lynn Willis, United Way of Pierce County | ||

| 12:45PM | Lunch & Exhibitors | Columbia Bank Lobby, Milgard Assembly, & Kopp Gallery |

| 1:45PM | D: Driving Financial Equity - The Case for Matched Savings Accounts | Milgard Assembly |

| Charisma Byrd, Kenan Hadzic, and Lynn Willis, United Way of Pierce County | ||

| 1:45PM | E: Justice Impacted Voices - Lessons Learned and Paths Forward | CP 108 |

| Elizabeth Rice, The Star Project | ||

| 2:45PM | Break | Columbia Bank Lobby |

| 3:00PM | F: Rewriting the Rules - Financial Healing for ALICE Households | Milgard Assembly |

| Jenefeness Franke, Fiscal Finesse Jim Cooper, United Ways of the Pacific NW | ||

| 3:00PM | G: Demystifying SBA and Small Business Lending | CP 108 |

| Scott Bossom, WaFd Bank Hannah Bracken, Milk & Honey Enterprises Wesley Nguyen, Verity Credit Union | ||

| 4:00PM | Break | Columbia Bank Lobby |

| 4:15PM | H: Closing - Where Rivers Meet | Milgard Assembly |

| Time | Session | Location |

|---|---|---|

| 8:00AM | Check-In, Breakfast, and Exhibitors | Cherry Park Lobby |

| 8:30AM | I: Welcome & Reflections on Day 1 | Milgard Assembly |

| 9:00AM | J: Bank On Around the Country - Innovative Approaches to Expanding Financial Empowerment | Milgard Assembly |

| Aaron Hirsh, CFE Fund | ||

| 10:00AM | K: Thriving Through Rapids & Whitecaps - Keys to Overcoming Collaboration Breakdowns | Milgard Assembly |

| 10:45AM | Break | Columbia Bank Lobby |

| 11:00AM | L: How We Built This - The Collective Impact of Financial Empowerment Programs | CP 105 |

| Abby McCutcheon & Jared Schapiro, Workforce Snohomish Josefina Carrillo, Latino Education & Training Institute (LETI) Rocky Hollenbaugh, United Indians of All Tribes Foundation | ||

| 11:00AM | M: Your Money, Our Mission - How Credit Unions Pursue Financial Well-Being for All | Milgard Assembly |

| Helen Gibson & Elizabeth Escobar, Express Credit Union | ||

| 12:00PM | Lunch & Exhibitors | Columbia Bank Lobby, Milgard Assembly, & Kopp Gallery |

| 1:00PM | N: Homeownership Pathways for All Our Communities | Milgard Assembly |

| Evelin Martinez, WA Homeownership Resource Center Erin Klika, WA State Dept. of Financial Institutions Titus Davis, Wa Trust Bank Nils Peterson, Hills and Rivers Housing Trust Ali Sehibani, Habitat for Humanity Seattle/King/Kittitas Janet Salvaza, El Centro de la Raza Sharon Snook & Pearl Nelson, HomeSight WA | ||

| 1:00PM | O: Making Financial Coaching Accessible for People with Disabilities | CP 105 |

| Ruth Daugherty, NW Access Fund | ||

| 2:00PM | Break | Columbia Bank Lobby |

| 2:15PM | P: Flowing as One - United in Power | Milgard Assembly |

Session Details & Descriptions

A: Welcome & Intention Setting

Start the day with a welcome from our MCs as they share what to expect from the forum and discuss what it means to have different Pathways to Financial Belonging.

- Mandy Lee, Verity Credit Union

- Jerrel Jones, Credit Revolution Education Director

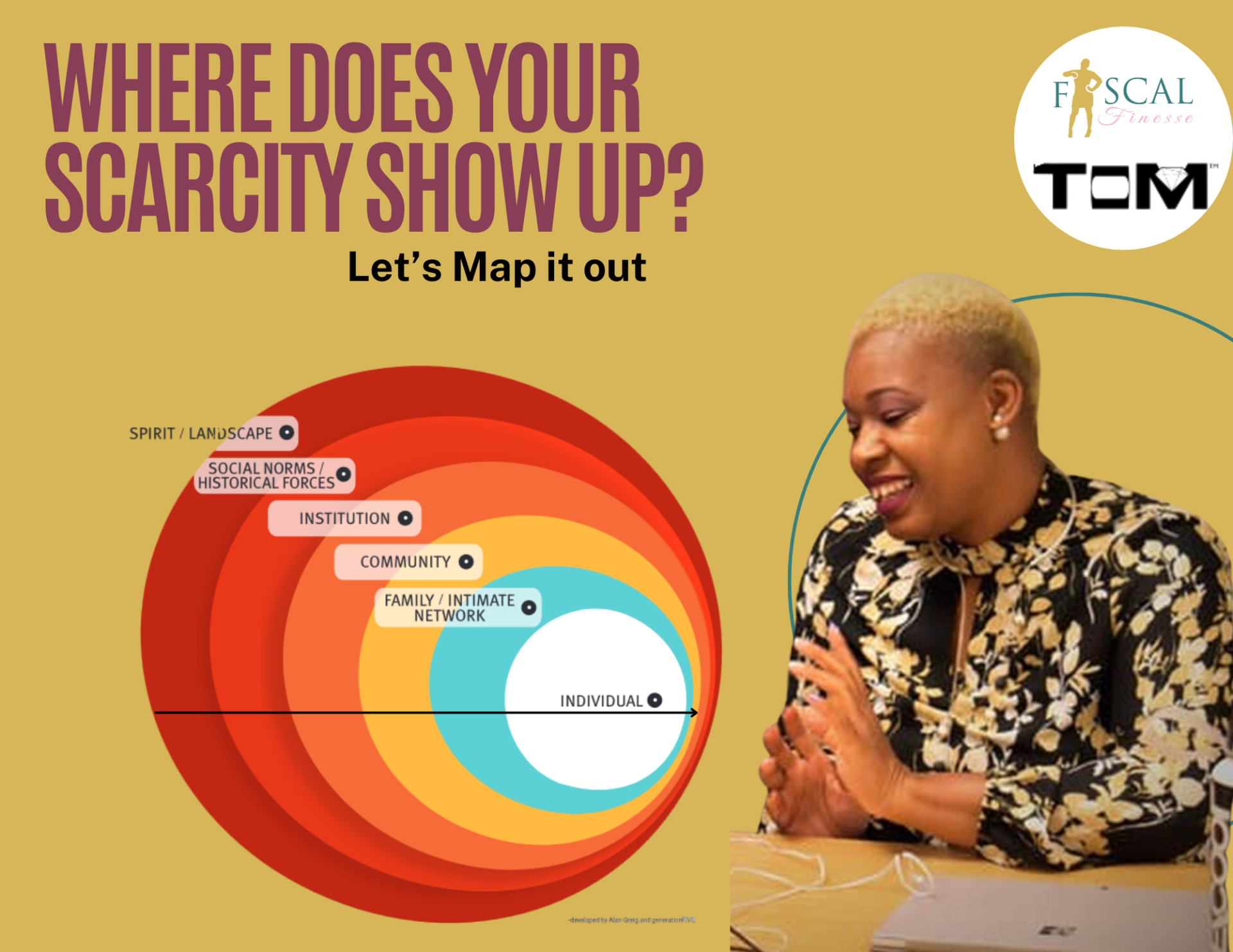

B: Interrupting the Spirit of Scarcity & Embracing Abundance

Thank you to BECU for sponsoring this session!

We’ll reflect on the growing call to lead from a mindset of abundance—and ask whether that mindset holds up in the face of funding cuts, political retrenchment, and service gaps. Together, we’ll explore how to hold both vision and realism, and how to distinguish bold strategy from toxic positivity.

- Alex Panagotacos, Alex Panagotacos Consulting, LLC

- Valeriana Chikoti-Bandua Estes, Necessary Interruptions, LLC

C: Money Trauma & Healing Centered Systems

Explore the intersection of financial trauma and healing-centered systems, drawing on community and lived experiences. Learn strategies for fostering resilience and belonging in financial education and services.

- Jenefeness Franke, Fiscal Finesse

- Lynn Willis, United Way of Pierce County

- Sabrina Smith, Columbia Bank

D: Driving Financial Equity - The Case for Matched Savings Accounts

Thank you to US Bank for sponsoring this session!

This panel discussion will highlight the launch of the WA State Department of Commerce’s first Individual Development Account (IDA) initiative and explore how cross-sector collaboration is driving economic mobility across the state. Whether you're a funder, practitioner, or policymaker, this session offers practical insight into launching and sustaining IDA programs.

- Lynn Willis, United Way of Pierce County

- Kenan Hadzic, United Way of Pierce County

- Charisma Byrd, United Way of Pierce County

E: Justice Impacted Voices - Lessons Learned and Paths Forward for Financial Inclusion

This session is grounded in direct engagement: we spoke with justice-impacted individuals across WA to hear about their financial journeys. We will present key themes and lessons learned and outline specific steps that financial institutions, community organizations, and policymakers can take to reduce barriers for justice-impacted individuals.

- Elizabeth Rice, The STAR Project

F: Rewriting the Rules - Financial Healing for ALICE Households

ALICE (Asset Limited, Income Constrained, Employed) households are not poor enough for public benefits but not stable enough for economic growth—leaving them stuck in an invisible crisis. This session will unpack the structural design of financial exclusion, spotlight the lived experience of the benefits cliff, and highlight what financial institutions and nonprofits can do differently.

- Jenefeness Franke, Fiscal Finesse

- Jim Cooper, United Ways of the Pacific Northwest

G: Demystifying SBA and Small Business Lending

Thank you to WaFd Bank for sponsoring this session!

One of the most daunting and stressful tasks for a business owner is knowing you need capital and trying to find it. Together, we will explore the paths that small business owners navigate to access capital, hear how entrepreneurs overcome challenges, and reaffirm the power of representative leadership.

- Scott Bossom, WaFd Bank

- Hannah Bracken, Milk and Honey Road

- Wesley Nguyen, Board of Verity Credit Union

H: Closing - Where Rivers Meet

Like rivers, we start as separate streams, but when we merge - we create strength, nourishment, and endless possibilities. End the day working together, sharing information and learnings to find the places where rivers meet.

- Mandy Lee, Verity Credit Union

- Jerrel Jones, Credit Revolution Education Directors

I: Welcome & Reflections on Day 1

Welcome to Day 2! Join our MCs as they reflect on day one and discuss expectations and intentions for day two.

- Mandy Lee, Verity Credit Union

- Jerrel Jones, Credit Revolution Education Director

J: Bank On Around the Country - Innovative Approaches to Expanding Financial Empowerment

Thank you to Columbia Bank for sponsoring this session!

Learn how governments, financial institutions, non-profits, Bank On coalitions and others are partnering to help increase access to safe and affordable banking products and creating scalable banking access opportunities for vulnerable and marginalized populations.

- Aaron Hirsh, Cities for Financial Empowerment Fund

K: Thriving Through Rapids & Whitecaps - Keys to Overcoming Collaboration Breakdowns

Explore how assumptions and biases create barriers to collaboration and innovation. Through reflection and table discussions, attendees will examine exclusion experiences and identify biases that shape outcomes across industries and regions.

- Mandy Lee, Verity Credit Union

- Jerrel Jones, Credit Revolution Education Director

L: How We Built This - The Collective Impact of Financial Empowerment Programs

Thank you to Mechanics Bank for sponsoring this session!

Join us to learn how local financial coaching programs have taken different paths to the same goal -- tailoring strategies to meet the unique needs of their communities. Hear their stories, explore their creative approaches, and leave with ideas to build or strengthen your own program.

- Abby McCutcheon, Workforce Snohomish

- Jared Schapiro, Workforce Snohomish

- Josefina Carrillo, Latino Educational Training Institute

- Rocky Hollenbaugh, United Indians of All Tribes Foundation

M: Your Money, Our Mission - How Credit Unions Pursue Financial Well-Being for All

Learn how credit unions advance financial well-being for all through inclusive products, practical tools, and community-driven design. Participants will leave ready to explore their own ideas to advance financial health within their organization.

- Helen Gibson, Express Credit Union

- Elizabeth Escobar, Express Credit Union

N: Homeownership Pathways for All Our Communities

Thank you to Banner Bank for sponsoring this session!

This session will provide an overview of affordable homeownership programs for low- to moderate -income households and first-time homebuyers. After a short presentation, we’ll break into small groups for deeper discussions with subject matter experts.

- Ali Sheibani, Habitat for Humanity

- Erin Klika, WA DFI

- Evelin Martinez, WHRC

- Janet Savalza, El Centro de la Raza

- Nils Peterson, Hills and Rivers Housing Trust

- Pearl Nelson, Homesight

- Sharon Snook, Homesight

- Titus Davis, Washington Trust Bank

O: Making Financial Coaching Accessible for People with Disabilities

Financial coaching can truly make a difference for people with disabilities. Together we’ll uncover barriers to financial wellness, share practical strategies, and build the tools to empower people with disabilities to achieve greater financial independence.

- Ruth Daugherty, Northwest Access Fund

P: Closing: Flowing as One, United in Power

Alone we are streams. Together, we are an unstoppable force turning rough waters into shared success. As we close our time together, join us for a powerful celebration of collaboration!

- Mandy Lee, Verity Credit Union

- Jerrel Jones, Credit Revolution Education Directors

Speakers & Moderators

Aaron is a Principal at the Cities for Financial Empowerment Fund where he supports Bank On integrations — finding ways to connect people to safe, affordable banking accounts. Prior to joining the CFE Fund, he was a high school teacher and a fellow with the Harvard Kennedy School Government Performance Lab. Aaron holds a B.A. in Political Science from Carleton College and an M.Ed. from the Harvard Graduate School of Education.

Abby is an Accredited Financial Counselor through AFCPE with over seven years of experience providing financial coaching and program management within government and nonprofit sectors. Having grown up in a financially unstable household, she developed a scarcity mindset and many fears around money. When approaching middle age, unexpected life changes compelled her to face her fears, rebuild her personal finances from the ground up, and begin her own financial empowerment journey.

Through her work in social services, Abby discovered the practice of financial coaching and became passionate about helping others in this transformational way. She is committed to providing the financial empowerment support she once needed but was not available in her area at that time. For the past three years, Abby has been with Workforce Snohomish, where she has played a key role in establishing the county's first-ever financial coaching program and revitalizing the Snohomish County Asset Building Coalition. She lives in Lynnwood, WA with her two human sons Jonas (17) and Elliot (13) and her furry dog-son, Felix (13).

Alex Panagotacos (Pan-a-go-tacos) is a strategist and facilitator who helps organizations find their boldness within and turn vision into actionable change rooted in community wisdom. She brings a brave, trauma-informed approach to her work and often weaves art into her facilitation as a tool for connection, reflection, and systems change. As the founder of Alex Panagotacos Consulting, she partners with leaders to craft values-driven strategies that center equity, belonging, and real-world impact.

In collaboration with Valériana Chikoti-Bandua Estes, Alex has co-led the Financial Empowerment Network’s strategic planning process, engaging board, staff, and community partners to create a “strategic compass” that strengthens FEN’s statewide impact and deepens its equity commitments. Together, they have encouraged FEN’s leaders to examine how beliefs around abundance and scarcity shape strategy, risk-taking, and community trust.

Her career spans leadership roles in state government, nonprofits, and grassroots initiatives, including directing strategic partnerships and leading award-winning, arts-based violence prevention programs. Raised among eccentrics and chickadees, Alex can identify just about any bird on the West Coast by sight, sound, or silhouette.

Ali Sheibani (Ah-Lee Shi-bah-nee) is the Director of Homeownership at Habitat for Humanity of Seattle-King and Kittitas Counties. His professional lending experience started in 2006, but he found his passion for non-profit work in affordable homeownership at Habitat in 2013.

Through his work at Habitat and then at HomeSight (2015-2021), a Washington Community Development Financial Institution, he has had the opportunity to support 1st generation homebuyers in creating wealth and opportunity for their families. As HomeSight’s Portfolio Manager, Ali helped to create an ITIN loan product as well as HomeSight’s first Race Based Special Purpose Credit Program loan product to support Black first-time homebuyers.

At Habitat, Ali helped create a debt remediation grant to help buyers remove the barrier of excessive debt obligations in qualifying to purchase a Habitat home. This pilot program has helped pay off debts for 10 buyers so far with a goal of at least 25% of all Habitat buyers utilizing this grant. Ali has also been involved with the Black Home Initiative as one of the facilitators of the Lending and Underwriting Subgroup. This subgroup was able to present underwriting recommendations to help lenders with the creation of effective mortgage products to address the specific needs of Black borrowers.

Charisma Byrd (kah-rizz-mah bird) is a Financial Coach at Tacoma Community College, where she supports students in building financial stability through budgeting, credit building, and asset development. She also supports participants in Individual Development Accounts (IDAs), guiding them in leveraging matched savings to reach long-term goals. With experience in financial empowerment, employment coaching, and resource navigation, she is dedicated to helping individuals achieve long-term financial health and self-sufficiency.

Liz Escobar (Liz ? /l?z/ — “LIZ” rhymes with “is" ; Es-Ko-BAR), Chief Business Officer of Express Credit Union in Seattle, Washington, started her career in the Peace Corps, assisting a financial cooperative in rural Paraguay. When she returned to the United States after volunteering, she found a position as a loan processor at Express Credit Union. Over the last 14 years, she continued to develop and grow with the credit union, expanding its reach through ITIN lending, financial education programming, financial counseling, and savings tools. She is a recent graduate of the prestigious Western Credit Union National Association's Management School. Her passion to see economic opportunity for all drives her daily work.

Elizabeth Rice (ih-LIZ-uh-beth rys, rhymes with "ice") is a dedicated human-focused strategist with a passion for restorative practices and a commitment to challenging societal preconceptions. For over two decades, Elizabeth has designed and implemented numerous programs both within and outside the carceral system. These initiatives focus on the design of operations and programs centered in restorative practice; fostering goal-based personal and professional growth, and leading to significant positive outcomes for the companies, organizations, and individuals she works with.

Erin Klika (/?kli.ka/) is the Diversity, Equity, and Inclusion (DEI) Director for the Washington State Department of Financial Institutions. This role supports equity in the financial services industry for the people of Washington.

Erin has 25 years of experience in the field of DEI. In her different roles she provided direct services for community members, ran regional and statewide programs, and used a co-creation model to implemented structure and system changes to meet community expectations.

Erin holds a Bachelor of Arts in Business Administration, with an accounting concentration and a minor in Dance, from the University of Washington.

Evelin Martinez is the Program and Partnerships Coordinator at the Washington Homeownership Resource Center (WHRC). She previously worked with Habitat for Humanity as a Family Support Coordinator, where she managed support for over 60 families.

In her current role at WHRC, Evelin conducts outreach to BIPOC homebuyers, leading work groups in partnership with the Black Home Initiative (BHI). As the Program and Partnerships Coordinator, she is also dedicated to fostering and building relationships with current and new partners, with a particular focus on lending and realty partnerships.

Outside of work, Evelin enjoys spending time with her family. She loves hiking with her spouse, child, and dog, and they delight in all things nature—from oceans, beaches, rivers, and lakes to hiking trails and simple trips to the park. Evelin and her family are also active volunteers at their local church, where they counsel pre-teens and teens, assist with the church’s finances and sound system, and teach Sunday school to children aged 3–8 years old.

Please welcome Hannah, a neurodivergent, ace of mexican heritage who against all obstacles founded her own company and championed a legacy of higher education for her family by being the first generation to graduate with a Bachelor's Degree in Business Management.

Helen Gibson (Helen ? /?h?l?n/ — “HEL” like in "help" + “?n” as in “button” ; Gibson ? /???bs?n/ — “GIB” like in "gibbon" + “s?n” w), CEO of Express Credit Union in Seattle, Washington, began her career as a high school teacher. In 2007, she joined credit unions as a financial educator and outreach specialist, connecting community members to financial capacity. Helen has developed and implemented partnerships and products that empower individuals in their financial journey, including credit building, accounts for minors, savings products, and community-aligned rewards checking. She believes all people need not just education but the tools to thrive. In addition to her role at Express Credit Union, Helen is a Ph.D. candidate through the University of Denver, studying the role of trust in firm performance, and determining a way to measure social performance.

Janet Savalza (JAN-it sah-VAHL-zah) has been with El Centro de la Raza since 2022, serving as a HUD-Certified Housing Counselor and Financial Empowerment Coordinator. In this role, she supports individuals and families in navigating housing challenges, building financial stability, and connecting with critical community resources. She also helps coordinate Washington State Housing Finance Commission (WSHFC)–sponsored homebuyer education seminars in both English and Spanish, expanding access to vital information for the community. A graduate of the University of Washington–Seattle, Janet earned her B.A. in Spanish in 2016. She is passionate about empowering community members with the knowledge and tools they need to reach their goals, create stability, and thrive. Through her work, Janet finds great fulfillment in helping people build stronger futures and ensuring that everyone has access to the opportunities they deserve.

Jared (JEHR-uhd) is Director of Financial Empowerment at Workforce Snohomish, where he leads the design and implementation of community-responsive financial coaching and workforce development programs. With over a decade of experience in the field, Jared specializes in creating holistic programs that integrate financial wellness services with career training to promote long-term economic mobility.

As an Accredited Financial Counselor (AFC) with a Master's in Teaching from the University of Washington, Jared brings both specialized expertise and educational background to his work developing data-informed, equity-centered programs. He has successfully launched financial empowerment departments from the ground up, supervises teams of financial coaches, and maintains strong partnerships across government agencies, nonprofits, and community organizations.

Jared's approach emphasizes community needs assessment, cross-sector collaboration, and evidence-based program improvement to ensure participants have access to comprehensive resources for meaningful career advancement and sustained financial stability.

Jenefeness Franke (Jenna Finesse Frank Ee), MBA is a powerhouse financial strategist, professor, author, and transformational speaker with over two decades of experience advancing economic justice and financial empowerment. She is the Founder and CEO of Fiscal Finesse Consulting, a CRP-verified Black, woman-owned organization rooted in trauma-informed care and cultural responsiveness, serving historically excluded communities across Washington State. As the architect of the nationally recognized Level Up Credit Improvement Movement, Jenefeness has helped participants increase credit scores, eliminate predatory debt, and collectively save hundreds of thousands of dollars through matched savings programs. Her work centers the voices of those most impacted by financial exclusion—low-income families, Black, Latine, and Tribal communities—and equips them with the tools to build lasting generational wealth. In addition to her consulting practice, Jenefeness is a business professor at Seattle Central College, where she integrates equity, belonging, and real-world financial literacy into her curriculum. Holding an MBA and pursuing advanced doctoral studies, she combines academic rigor with lived experience to shift mindsets from scarcity to abundance while fostering inclusive financial systems. Her passion is clear: to create pathways of belonging where individuals furthest from opportunity can thrive, heal, and reclaim their financial power.

Jerrel Jones is a passionate advocate for justice, financial empowerment, and closing the wealth gap in underserved communities. As the founder of Credit Revolution Education Directors, he equips individuals with the tools to build generational wealth through financial literacy, entrepreneurship, and credit education.

A living testament to resilience, Jerrel transformed his life from "the gutter to the rooftop"—using his journey as inspiration to motivate others. Beyond his work, he’s a dedicated family man, proud multiple homeowner, and a force for systemic change.

Mission: "To turn financial survival into financial revolution—one household at a time."

Jim is the President and Chief Executive Officer for United Ways of the Pacific Northwest, the regional association for 32 local United Way organizations in Idaho, Oregon & Washington. In this work he has also served as the interim CEO for five different local United Ways. He is a founding member of the United Way Worldwide Disaster Resilience Committee.

Jim is also an elected (2011, 2013, 2017, 2021) member of the Olympia City Council where he serves on various committees.

Jim has 30 years of nonprofit, corporate and government leadership experience working with community organizations, governments and businesses to achieve positive outcomes for people and the environment.

As an Army veteran, Eagle Scout and activist, Jim works to stand up for issues that financial mobility while aiming at his personal goal of the Pacific Northwest being the best place in America to grow up and live.

Jim loves the outdoors and lives in Olympia, WA with his wife Thomasina, daughter Maggie, and their rescue dogs Rusty & Meli.

Josefina (J sounds like H) Carrillo Gamboa is part of the Eviction Prevention and Falily Resource Specialist team at Latino Educational training Institute, where she supports families in achieving financial stability and accessing vital community resources. As a former financial coach, she has provided one-on-one guidance to clients on budgetin, debt manangement, and credit building. With over 25 years of experince managing her family business, Josefina brings strong financial and leadership skills to her work. She is passionate about serving the Latino community, breaking down barriers, and empowering fmilies to thrive through education and support.

Kenan Hadzic (Ken-Ann Hajj-ich) is an Accredited Financial Coach, AFC® with United Way Of Pierce County dedicated to helping individuals and families achieve stability through asset building. With a focus on Individual Development Accounts (IDAs), Kenan has worked to expand access to matched savings opportunities that empower clients to reach life-changing financial goals. This program has been targeted for minority communities in Washington State who continue to face adverse outcomes from the War on Drugs, helping address long-standing inequities in access to capital and economic opportunity. In Kenans work he has seen firsthand the transformative power of IDAs: • Young adults purchasing reliable cars without being trapped by predatory interest rates. • Entrepreneurs sharing how these grants saved their small businesses during these difficult economic times. • Families and individuals building savings accounts that open doors to greater financial independence. Kenan will share the successes of the program’s growth, highlighting the impact on local communities. Passionate about financial equity and sustainable solutions, Kenan believes in the power of accessible savings programs to break cycles of debt, foster entrepreneurship, and create an even financial playing field for everyone.

C. Lynn Willis, a Chicago native, is a veteran, nonprofit leader, and community advocate. She holds degrees from Cheyney University, the Community College of the Air Force, and Troy University. A 25-year U.S. Air Force Reserve veteran, she brings expertise in logistics, education, and leadership. Now based in Washington, she is the Director of Family Stability Initiatives at United Way of Pierce County, advancing economic mobility through the Center for Strong Families. She serves on several boards, including Bank On Pierce County and the Golden 22 Foundation, and is an active member of 100 Women of Seattle and other coalitions.

Mandy Lee (MAN-dee LEE) (they/them) is the Community Impact Manager at Verity Credit Union, where they lead efforts in financial wellness, partnerships, and grants with a focus on closing the racial wealth gap. Their work centers on co-creating programs with communities, such as Grants for Growth for microbusinesses and nonprofits, and financial education built with young adults, with the purpose to expand access to fair and equitable financial solutions.

With a background in nonprofits, disaster recovery, and economic development, Mandy is known for blending humor with hard work, turning daunting spreadsheets into tools for storytelling and equity. Their approach is rooted in transparency, shared power, and community voice.

When theyre not leading impact initiatives, Mandy is usually in Tacoma with their partner and 17,000 pets, enjoying a giant mug of chai, watching reality TV, or reading a book. Don't ask what they are currently reading, unless you're ready for the answer.

Nils Peterson (sounds like pills) has served as the Executive Director of Hills and Rivers Housing Trust since 2014. The Trust is based in Moscow, ID and also serves Whitman County in Washington. Peterson came to the Trust after an early retirement from Washington State University. During his tenure the Trust sold 3 affordable houses fee simple, and then switched to the Community Land Trust (CLT) model. The first three CLT homes were sold in 2020. There are now 8 houses in portfolio, one sale pending in Sept, one unit for sale and one under construction. The Trust is also collaborating with our local Habitat affiliate who is constructing a home on Trust land.

After a busy decade as a member of the Seattle music scene Pearl Nelson (aka Champagne Champagne ) took a step back to reevaluate. That break allowed him to explore other passions, including coffee and homeownership. ,Stepping away from touring, and embracing new paths. He ventured into sales with Vita, discovering a genuine passion for helping people and building relationships. Although he initially loved sales, he wanted to do it differently—more authentically—by focusing on service rather than sales pitches. .

His interest in real estate was a long-standing dream, even while he was immersed in music. It took time to find the right route, but he realized that he could combine his desire to help others with his skills. His experience navigating industry dynamics, especially as a person of color, shaped his understanding of what it means to be a real estate agent. This led him to Homesight three years ago, aligning with their mission and community-centered approach.

Currently, Nelson is working on the U-lex Coop as an assistant project manager, continuing his dedication to service, community, and helping others find their place.

Troy “Rocky” Hollenbaugh Jr. (Rok-e Hall-n-bah) is the Financial Education Coach for United Indians of All Tribes Foundation (UIATF). He leads the organization’s financial literacy programs, including the B.A.N.K. (Build Assets, Nurture Knowledge) initiative, which has empowered over 1,000 participants to build financial confidence, reduce debt, and create sustainable wealth through culturally relevant education.

Ruth Daugherty (last name - rhymes with party) joined Northwest Access Fund in 2022 and is the Director of the Financial Coaching Program. She is an Accredited Financial Counselor and a Certified Benefits Planner and has a Master's Degree in Special Education. Ruth has over 15 years of experience working with the disability community and is passionate about providing the resources, education, and support needed for people with disabilities to participate fully in their communities. In her free time, Ruth likes to feed people good food, try new things, and go on adventures with her husband, 2 young kids, and exceptionally fluffy pup.

Sabrina Smith (Suh - Bree - Nuh) serves as Vice President, Community Lending Manager at Columbia Bank, overseeing community lending efforts across Washington State and Idaho. With over 30 years of experience in the mortgage services industry, Sabrina brings a deep commitment to advancing equitable homeownership opportunities, particularly for underserved and underrepresented communities.

Her journey into community lending began in Portland, Oregon where she witnessed firsthand the challenges faced by black and brown families in accessing mortgage loans. That experience sparked a lifelong passion for financial education and advocacy, leading her to develop and deliver first-time homebuyer workshops and collaborate with nonprofit partners to remove barriers to homeownership.

In her leadership role, Sabrina forges strategic partnerships with housing focused organizations, real estate professionals, and community development agencies to promote financial literacy, support affordable housing, and expand access to down payment assistance programs. She is also an active member of several regional boards and committees, including NAMMBA, The Urban League of Metropolitan Seattle Guild, NAREB Western Washington Realtist the United Negro College Fund. Outside of her professional work, Sabrina enjoys cooking, traveling, and spending quality time with her family.

Sabrina is honored to support individuals and families on their path to homeownership and remains deeply committed to fostering inclusive, sustainable communities across her region.

Scott Bossom (sounds like "boss-um") is a lifelong Pacific NW resident, born and raised in NE Portland and now residing in Silverdale, WA. He has a 30+ year career in lending with a focus over the last 20 years on SBA programs and a passion for helping small businesses navigate what can be a daunting topic, access to capital. Prior to joining WaFd Bank in March 2025 to help start and build and its SBA Lending Department, Scott led successful SBA teams at two other banks including Columbia Bank, which he helped grow into the #1 SBA lender in WA and OR. Before joining Columbia Bank, Scott was primary Lender Relations Specialist at the SBA's Portland District Office for over six years – providing support and guidance to active SBA lenders on both the 504 and 7a programs as well as working with borrowers seeking funding. Through all of his positions – Scott has gained a strong appreciation and love for supporting what are the “backbone” of our economy – small businesses.

Sharon Snook is a Senior Project Manager of Real Estate Development at HomeSight, a nonprofit Community Development Corporation and Community Development Financial Institution based in Southeast Seattle. She joined HomeSight in 2025, transitioning from a background working with for-profit developers. Recognizing the critical need for affordable housing, Sharon shifted her focus to directly contribute to community betterment. She now supports the development of affordable residential ownership and community facility projects, while also providing project management services to nonprofit and community-based organizations throughout the Puget Sound region. Prior to her current role, Sharon was involved in a variety of new construction projects, including condominiums in Beacon Hill and Bonney Lake, as well as single-family homes across the Seattle area, including Blaine, Sedro Woolley, Poulsbo, Bremerton, Silverdale, Monroe, Snohomish, North Bend, Bothell, Lacey, Bellevue, Kirkland, and Shoreline. Sharon holds a degree in Archaeology from the University of Alaska Fairbanks and later earned a degree in Interior Design from Harrington College of Design in Chicago. She further advanced her expertise with a master’s degree in urban planning and policy from the University of Illinois at Chicago, through the College of Urban Planning Program. Additionally, she is proficient in Geographic Information Systems (GIS), which enhances her ability to analyze and manage urban development projects effectively.

Titus (Tight-Us) is a residential loan officer with a history of working in the lending industry for the pasts 25 years. Being knowledgeable in real estate buying, selling, flipping, rehabbing and holding strategies allows me to understand the nuances of the home buying and underwriting processes. I have a strong ability to build relationships and understand my client’s needs which makes working together an enjoyable experience, especially since dealing with real estate can be a very stressful time period.

Valeriana (Val-eh-ree-ya-na | chee-ko-tee | Bun-dwa | Ess-T) is an evolving abolitionist, Born into this world as a Refugee in the country of Zambia, Valeriana hails from the Republic of Angola and native to the Ovimbundu peoples of the Southern Bantu Peoples of Angola. Valeriana Chikoti-Bandua Estes's pronouns are she/her and she comes from a family of freedom fighters, disrupters and organizers who shaped and inspired her journey towards social justice efforts so early on in her childhood. Unfortunately due to Portuguese colonization and a civil war in Angola, Valeriana's family fled as refugees when she was 3 years old to seek refuge in the Island country of Papua New Guinea right above Australia. Her unique upbringing allowed her to deepen her understanding of organizing through mutual aid efforts due to the comradery that she was exposed to from fellow African Immigrants, Indigenous Pacific Islanders and Asian community members.

Valeriana later moved to the United States in 2007 in pursuit of futhering her education, and as a result navigated a variety of immigration statuses for 17 years until she officially became a U.S citizen exactly one year ago. In addition Valeriana holds a Masters degree in Global Governance and International Security, she speaks four languages, she is a professional public speaker and she has had a diverse working career that has allowed her to serve as a Diplomat in the United Nations, serve as an Executive Director in the anti-violence movement to organize resources and uplifting immigrant communities who are victims and survivors of gender based violence. In addition to the many hats that she wears she has her own consultancy called Necessary Interruptions where she supports non-profits, educational institutions and small businesses through a range of offerings that center uplifting equity and interrupting white supremacist practices and more recently she is also the co-founder of ETU Swimwear an eco friendly, body affirming swimwear line created for a plethora of body curves.

Valeriana also serves as the Executive Director of The Social Justice Fund NW that is based in Seattle and serving five state regions in Oregon, WA, Wyoming, Montana and Idaho. Since 2018 she has become a Washingtonian who resides in Spanaway. However, it is important to note that of all the titles that she holds, being a Mommy to Zaya (Pronounced: Zaah-ya) and Anaya and a life partner to her short king Ray bring her, her greatest joy.

Valeriana continues to believe that to become the wildest dreams of our ancestors we must be about brewing good trouble.

Wesley is a proven leader in economic development and inclusive growth, with over 25 years of multi-sector experience spanning local government, international development, and social enterprise. As Economic Development Coordinator for the City of Lacey, he leads initiatives that foster small business success, attract investment, and create pathways to prosperity for the community. Wesley’s global perspective—shaped by designing workforce policy at the state level, launching impact-driven ventures in Cambodia, and mentoring startups in Mongolia—infuses his work with creativity and resilience. A board member at Verity Credit Union, he helps guide community-centered financial solutions through strategic governance. His international work with USAID, Habitat for Humanity, and the Peace Corps demonstrates dedication to driving meaningful change through hands-on efforts and impactful initiatives. With degrees from Georgetown and La Trobe Universities and global life experience, Wesley brings cultural fluency, sharp strategy, and an unwavering focus on equitable growth.

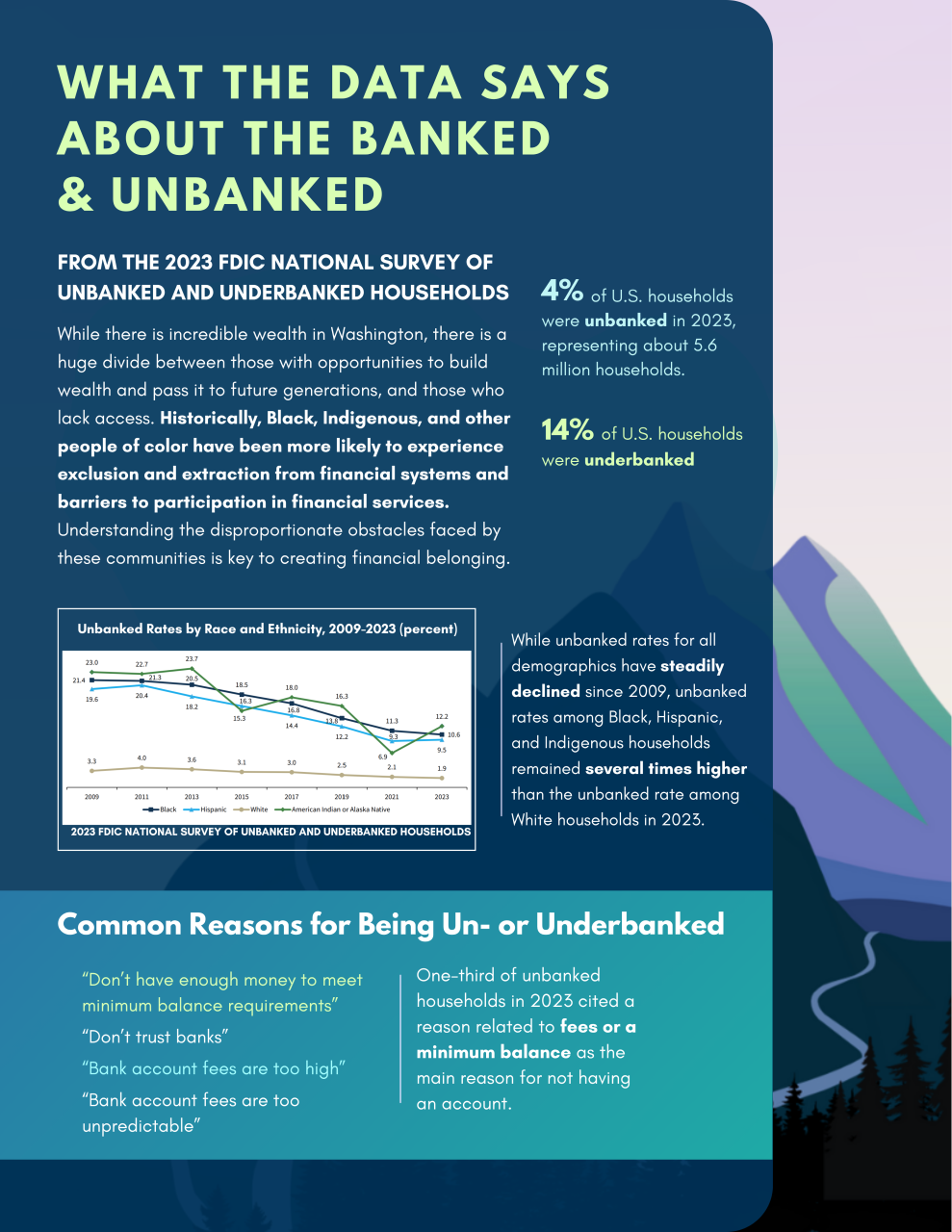

Financial Wellbeing in Washington

Partners, Supporters, & Sponsors

Session Worksheets

Session P